Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "payroll tax"

Status: New

Status: NewGoogle Cloud

Skills you'll gain: Gmail, Data Loss Prevention, Data Management, Data Governance, Google Workspace, Records Management, Data Security, Personally Identifiable Information, Data Storage, Data Import/Export, Cloud Storage, System Configuration

Status: Preview

Status: PreviewUniversity of Pennsylvania

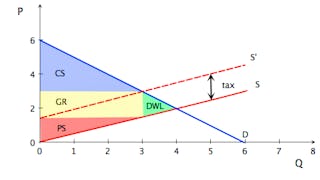

Skills you'll gain: Supply And Demand, Economics, Market Dynamics, Market Analysis, Resource Allocation, Tax, Public Policies, Cost Benefit Analysis, Decision Making

Skills you'll gain: Tax Compliance, Tax Laws, Compliance Reporting, Compliance Management, Regulatory Compliance, Corporate Tax, Tax, Document Management, International Finance

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Operations Management, Operational Efficiency, Process Analysis, Process Management, Process Improvement, Lean Methodologies, Workflow Management, Continuous Improvement Process, Capacity Planning, Quality Management, Supply Chain Management, Statistical Process Controls, Process Flow Diagrams, Resource Utilization, Root Cause Analysis

Status: Free Trial

Status: Free TrialCoursera Instructor Network

Skills you'll gain: Ledgers (Accounting), Tax Planning, Auditing, Tax Compliance, Income Tax, Financial Auditing, Financial Reporting, Compliance Management, Accounting Records, Regulatory Compliance, Financial Controls, Reconciliation

Status: Preview

Status: PreviewKorea Advanced Institute of Science and Technology(KAIST)

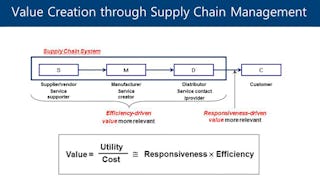

Skills you'll gain: New Product Development, Supply Chain, Supply Chain Management, Supply Chain Planning, Quality Management, Operations Management, Logistics Management, Supplier Management, Transportation, Supply Chain, and Logistics, Inventory Management System, Coordinating, Corporate Sustainability, Value Propositions, Continuous Improvement Process, Consumer Behaviour, Cross-Functional Collaboration, Decision Making, Complex Problem Solving

Status: Preview

Status: PreviewErasmus University Rotterdam

Skills you'll gain: Consumer Behaviour, Market Dynamics, Financial Market, Financial Systems, Economics, Economic Development, Market Analysis, Tax, Economics, Policy, and Social Studies, Public Policies, Environmental Issue, Social Sciences, Socioeconomics, Supply And Demand, Behavioral Economics, Decision Making

Coursera Instructor Network

Skills you'll gain: Payroll, HR Tech, Compensation Strategy, Generative AI Agents, Compensation and Benefits, Benefits Administration, Compensation Analysis, Compensation Management, Payroll Processing, Human Resource Management, Human Resources, Operational Efficiency, Data Ethics, Workforce Management, AI Personalization, Automation, Business Ethics, Employee Engagement

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Investments, Compliance Reporting, Tax, Tax Planning, Private Equity, Investment Management, Compliance Management, Financial Regulation, Tax Laws, Real Estate, Financial Market, Regulatory Requirements, Due Diligence, Financial Services

Status: Preview

Status: PreviewUniversity of Illinois Urbana-Champaign

Skills you'll gain: Fund Accounting, Governmental Accounting, Non-Profit Accounting, Financial Analysis, Financial Statement Analysis, Financial Statements, Governance, Performance Analysis, Financial Reporting, Revenue Recognition, Generally Accepted Accounting Principles (GAAP), Accounting, Compliance Management, Cash Flows, Tax Compliance, Reconciliation

Status: Free Trial

Status: Free TrialRice University

Skills you'll gain: Economics, Supply And Demand, Market Dynamics, Tax, Market Analysis, International Relations, Operating Cost, Policy Analysis, Consumer Behaviour, Decision Making

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Supply And Demand, Economics, Business Economics, Market Dynamics, Tax, Resource Allocation, Consumer Behaviour, Price Negotiation, Cost Management, Production Management

Searches related to payroll tax

In summary, here are 10 of our most popular payroll tax courses

- Administración de datos de Google Workspace: Google Cloud

- Microeconomics: The Power of Markets: University of Pennsylvania

- Transfer Pricing: Basic concepts and compliances: PwC India

- Introduction to Operations Management: University of Pennsylvania

- Financial Reporting: Ledgers, Taxes, Auditing Best Practices: Coursera Instructor Network

- Supply Chain Management: A Learning Perspective : Korea Advanced Institute of Science and Technology(KAIST)

- Introduction to Economic Theories: Erasmus University Rotterdam

- GenAI for Compensation, Benefits and Payroll: Coursera Instructor Network

- Alternative Investments and Taxes: Cracking the Code : University of Illinois Urbana-Champaign

- Governmental Accounting II and Nonprofit Accounting: University of Illinois Urbana-Champaign